Trade settings

Manage your multichain trading settings and preferences.

OPSIN gives you full control over how your trades are executed, even in the most volatile market conditions. To adapt quickly, you can create and switch between 3 customizable trade presets — P1, P2, and P3 — depending on the trade type and current market dynamics.

Each preset allows you to define distinct settings for both BUY and SELL orders, so you can fine-tune your strategy for every situation.

Not sure which settings you're currently using?

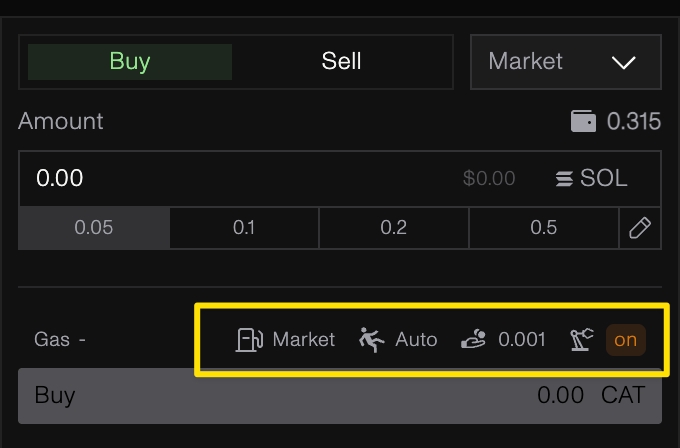

You can quickly view your active trading settings directly above the Buy button. This helps you double-check key parameters like slippage, priority fee, and bribe before executing a trade.

Priority fee (Solana)

To speed up your transactions—especially during periods of high volatility—you can set a priority fee.

This fee is added on top of the base gas cost and goes directly to validators or miners, incentivizing them to prioritize your trade in the next block.

During periods of high volatility or hyped token launches, increasing your priority fee helps ensure your transaction is processed faster and doesn’t fail.

You can choose between 4 options:

Market: current market gas ×1.5

High: current market gas ×5

Turbo: current market gas ×10

Custom: input your desired amount of SOL to be used as priority fee (max is 2 SOL).

Gas priority (EVM)

This is conceptually the same as the priority fee but for all the supported EVM chains. You can choose between 3 options:

Medium: current market gas ×1.5

Fast: current market gas ×2

Ultra: current market gas ×3

Bribe (Solana only)

Extra boost for even faster transactions

On Solana, a bribe is an optional payment sent directly to validators to incentivize faster inclusion of your transaction. It’s especially useful during periods of congestion, like hyped token launches or sudden market spikes.

OPSIN sets a default minimum bribe of 0.001 SOL, but you can raise it at any time to boost the priority and speed of your transaction. There’s no maximum limit.

We recommend increasing the bribe when:

You're trading during high-volume moments

You need faster fills to enter before everyone else

Slippage

Protection vs price volatility

Slippage is the maximum percentage of price movement you're willing to accept between the time you place your order and the moment it gets executed.

Setting your slippage helps ensure your trade goes through even if the price changes slightly, but if the price moves beyond your slippage tolerance, the transaction will fail.

Example: Let’s say you're buying a token at $0.10 with a 30% slippage setting. That means you're okay with the final price being as high as $0.13. If the price jumps to $0.14 before your trade is confirmed, the trade won’t go through.

MEV protection (Solana only)

Protect your trades from MEV attacks

OPSIN includes built-in MEV Protection on Solana to guard your trades against front-running and sandwich attacks — especially critical during high-slippage or low-liquidity conditions.

Instead of using public mempools (where bots monitor transactions), OPSIN routes your trades through Bloxroute’s private relay network.

This prevents malicious actors from seeing and exploiting your transaction before it’s confirmed.

MEV protection becomes crucial when trading with high slippage, large size, or volatile tokens. Without it, you risk getting front-run or sandwiched by bots that exploit your transaction for profit.

Last updated